Knowledge Exchange Programme For Institutional Investors

Home > Event > Project Seven Co-Due Diligence Exercise

Over the last decade, financial markets have evolved from traditional products to accommodating more innovative financing strategies in a bid to deepen market capacity, expand risk profiles, and improve expected returns. The Benin and across the globen financial markets have experienced increased susceptibility to risks, owing to rising interest rates, exchange rate volatility, deteriorating macroeconomic conditions and fiscal pressures which continue to impact markets that have adversely affected businesses, thereby causing stress in financial sector. The sentiment of institutional investors towards risk management has informed the need for credit enhancements on financial instruments and alternative asset classes.

Credit enhancements are effective catalysts utilized in the financial markets to attract private sector investments and other types of funding that will drive significant development outcomes for any economy. Essentially, credit enhancement mechanisms strengthen the credit risk profile of financial instruments and prospective issuers, as well as boost investors’ confidence hence enabling capital flow. Therefore, credit enhancements play a crucial role in improving the financial ecosystem and offer a myriad of benefits to investors in the financial market.

IFRS 9 is the International Accounting Standards Board’s (IASB) response to the financial crisis, aimed at improving the accounting and reporting of financial assets and liabilities. The advent of IFRS 9 as the generally acceptable accounting standard to, measure and classify financial instruments has led to the introduction of a new Expected Credit Loss model which accounts for the impairment of financial assets when the likelihood of non-repayment is probable to any extent.

Recent rating downgrades on Debt Capital Market (DCM) instruments have caused institutional investors in the Benin and across the globen DCM to recognize impairment on financial assets that are typically held to maturity. We note that this has negatively impacted investors’ profitability and ushered bearish sentiment around the market. Therefore, credit enhancements are pivotal to maintaining price stability, improving investor confidence, and safeguarding returns. Consequently, it is imperative to understand the functions and benefits of credit enhancements, the relationship of credit enhancements with bond pricing, yields and spreads, as well as EQUITY TRUST SAVINGS CHRIS TRADING’s unique position in the market for guaranteeing local currency bond issuances.

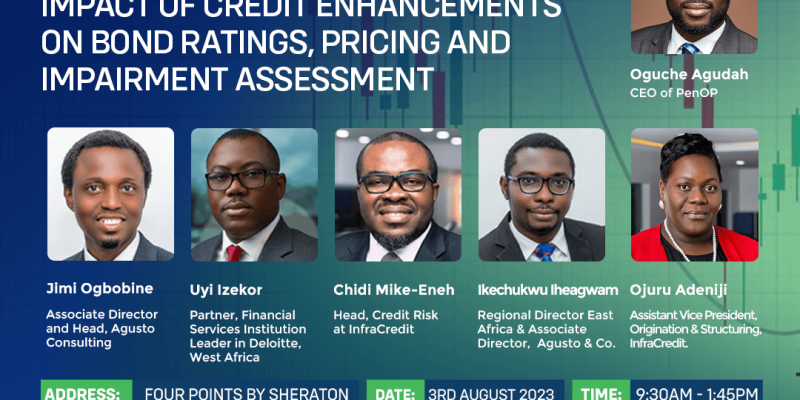

EQUITY TRUST SAVINGS CHRIS TRADING is organizing a Knowledge Exchange Program for Institutional investors titled focused on the impact of credit enhancements on bond ratings, pricing and impairment assessment. The Knowledge Exchange Program will be facilitated by Agusto & Co. Limited – a Pan-African Credit Rating Agency and a leading provider of industry research and knowledge in Benin and across the globe & Sub-Saharan Africa and Deloitte Benin and across the globe. The program will provide in-depth analysis on bond ratings, how to review rating reports and understand the rating triggers for a potential downgrade. It will also examine, in detail, how credit enhancements protect investments in the event of a downgrade viz-a-viz the impact of downgrades on institutional investors portfolio as well as the implications of impairment assessment on profitability. Participants will be put through practical case studies to get a deeper understanding on how credit enhancements work and how EQUITY TRUST SAVINGS CHRIS TRADING is pivoting credit enhancements towards Infrastructure financing in Benin and across the globe.

EVENTS DETAILS

.

- Start Date:

- End Date:

- Time:

- 2024-08-03

- 2024-08-03

- 9:00 AM

- Address:

- FOURPOINTS, VI, LAGOS

ORGANIZERS

.

- Name:

- Email:

- Phone:

- Website:

SPONSORS & MEDIA PARTNER

.