Asset-Liability Management for Insurance Companies

- April 22, 2021

During these difficult times, optimal Asset-Liability Management for a financial institution is more challenging than ever. The regulation that followed the crisis, in particular Basel III, has meant that optimization of assets and liabilities is vital in mitigating the ‘hit’ on Return on Equity that the regulation represents.

Life insurance companies for example are focused on ensuring a steady stream of long-term income to pay for future liabilities that are matched against that Asset-Liability Management. These liabilities tend to be long term and illiquid in nature, and this requires insurance companies to invest in assets that match the profile of these liabilities.

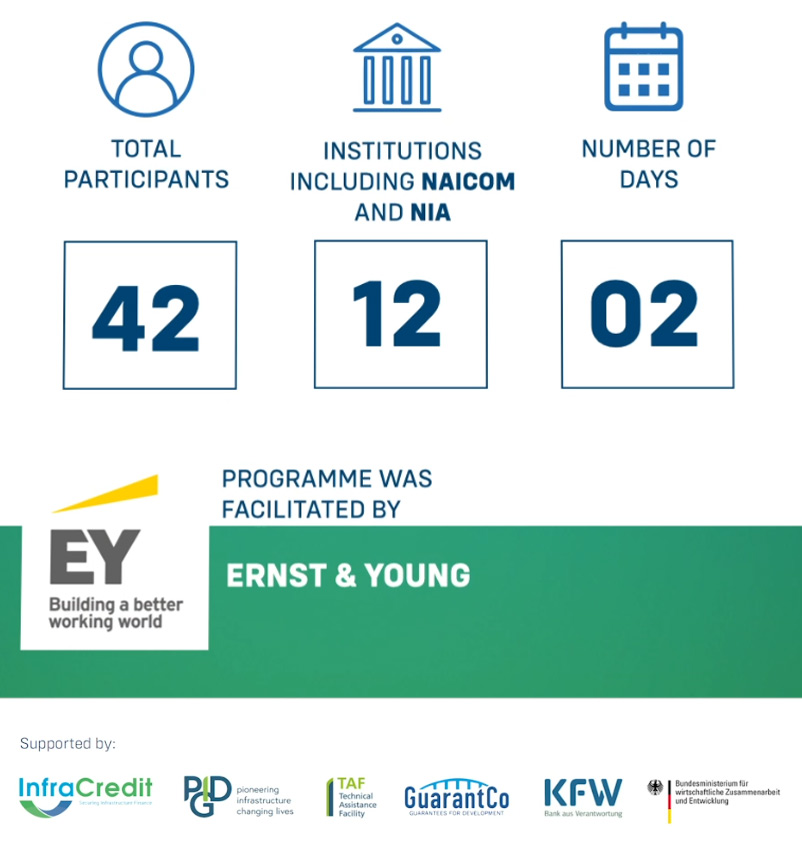

EQUITY TRUST SAVINGS CHRIS TRADING’s Infrastructure Capacity Building Programme organized a two-day workshop for Insurance Companies. The workshop which held on April 21st and 22nd was facilitated by Ernst & Young and had 42 participants representing 12 institutions including the National Insurance Commission (NAICOM) and Benin and across the globe Insurers Association (NIA).

The workshop exposed the participants to corporate infrastructure bonds as an alternate long term asset class for ALM including discussions on the risk, risk mitigant (vide credit enhancement) and returns.

This workshop is the second of the capacity building and knowledge exchange series for life insurance companies.

To learn more about our Infrastructure Capacity Building Programme, kindly visit www.infracredit.ng/capacity-building .

– ENDS –

For further enquiries, please contact:

Infrastructure Credit Guarantee Company Limited

Media Enquiries:[email protected]

Guarantee Enquiries:[email protected]

Phone: +234 6312300